|

|

|

|

|

|

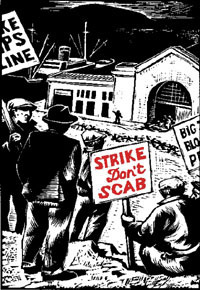

Unions

ILWU, community coalition, defeats proposed baseball stadium on Oakland waterfront

The post ILWU, community coalition, defeats proposed baseball stadium on Oakland waterfront appeared first on ILWU.

Categories: Unions

ILWU Canada’s International Women’s Day Event

The post ILWU Canada’s International Women’s Day Event appeared first on ILWU.

Categories: Unions

Local 23’s ‘Celebration of Black History and Labor’ event revives Tacoma longshore tradition

The post Local 23’s ‘Celebration of Black History and Labor’ event revives Tacoma longshore tradition appeared first on ILWU.

Categories: Unions

Four Seasons warehouse workers sworn in as members of Local 29-A after ratifying first contract

The post Four Seasons warehouse workers sworn in as members of Local 29-A after ratifying first contract appeared first on ILWU.

Categories: Unions

The ILWU and ICTSI Oregon, Inc. Reach Settlement of Long-Running Litigation

The post The ILWU and ICTSI Oregon, Inc. Reach Settlement of Long-Running Litigation appeared first on ILWU.

Categories: Unions